It doesn’t exactly take a rocket scientist to figure out that studying abroad is expensive. And not just the tuition fees. During your stay there, the living expenses, especially in cities like New York or London, really start to add up. But hey, chin up! Because there are options out there. And the easiest of them all is an education loan.

That’s right! It is the magic wand that will help you fund your dreams of a quality education in a country of your choice. And that’s what we are covering in today’s blog. It is your go-to guide to financial planning for studying abroad.

Without further ado, let’s jump right in!

Types of Education Loans

First and foremost, you have to know what kind of education loans are available to you. In broad strokes, education loans in India can be categorized based on security and the kind of education they fund.

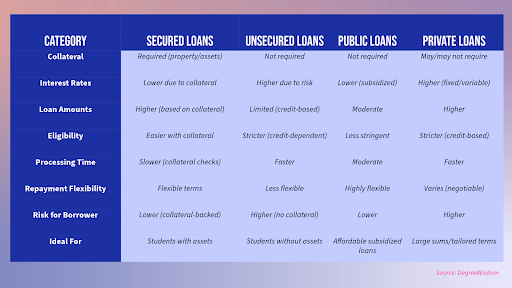

When security is a concern, there are secured and unsecured education loans. Secured loans are the ones where a bank will expect some sort of collateral from you (should you fail to pay it back). It can be a property, a fixed deposit or any other valuable asset. Such loans don’t have much of an eligibility criterion as long as there is a collateral on the table. So, they are easier to get. And since they are backed by collateral, there is not much risk for the bank. It means higher loan amounts and lower interest rates.

Unsecured loans, on the other hand, are not backed by collateral. Therefore, they have very high interest rates. And you need a co-applicant with an impressive credit history. However, they are processed faster because of less documentation.

And then there are public and private education loans. Public loans are backed by government subsidies. This means they have lower interest rates and quite some flexibility in repayment options. Private education loans are, however, given out by private institutions like banks. So, you are likely to get a higher loan amount but at the cost of higher interest rates, which may increase over time.

Eligibility Criteria and Required Documents

The more you understand your loans, the easier your life gets. So, before applying for an education loan, let’s make sure you understand its eligibility criteria and any required documents or paperwork you may have to take care of.

Academic Records –

First and foremost, your academic records. Any bank will want to see a proof of your enrollment in an academic program at an accredited college. So, here you will have to provide your transcripts, a letter of acceptance, fee details, etc.

Income Proof –

It is a crucial requirement, especially for unsecured loans as it allows the bank to assess your capacity to pay back the loan. If you are employed, you will have to provide your salary slips (3-6 months). Besides, you will have to submit ITR (2-3 years) and bank statements (last 6 months).

Collateral Requirements –

Collateral is a crucial requirement, especially for secured loans as it mitigates the bank’s risks. Its value should be enough to cover the loan amount. You will need to present ownership documents of the property you are offering as collateral. Also, there should be a valuation report (prepared by a certified appraiser) attached.

Other Requirements –

These are pretty basic requirements such as identity proof, address proof, and if required, co-applicant information.

Loan Application Process

There are several steps to this process from initial loan application to final approval. Let’s go through them all, one step at a time.

First, you choose a bank. This step is the foundation of your financial planning. Make sure you are thorough in our research. Compare different financial institutions, their interest rates, the amount of loan, repayment options and conditions, and last but not least eligibility terms.

Next, you move ahead to filling out the application form. Whether it is online or offline, it totally depends on the bank. Make sure all the information you provide in the form is accurate. If required, double-check everything.

Then, comes the part where you submit the required documentation. Don’t forget to get a bunch of passport-size photographs along with everything we mentioned in the last section.

Once you have submitted the documents, you have to attend an in-person interview. Take this opportunity to discuss your academic background, the course that you are enrolled in, and your future plans.

Then, your application and documents are reviewed by the bank.It may take some time. If required, they may even do some sort of verification, such as a home visit.

And now, it is time for the loan approval process. If everything goes right, you get an offer letter from the bank. We recommend you take your time with all the terms and conditions in there.

Finally, once you accept the offer, the bank disburses the loan. Congratulations!

Loan Interest Rates and Repayment Options

These are the key factors that will most affect your ability to manage your education loan. So, again, be thorough when you research them.

When it comes to loan interest rates, there are fixed rates and then floating or variable rates. Fixed rates are quite self-explanatory and you are most likely to get those in government-backed loans. Floating rates, however, change with market rates (MCLR or Repo Rate). If you get a loan with floating interest rates, your monthly payments will be affected by it. Significantly.

Now, whether you get a lower or higher interest rate, it depends on your credit score or history. If you have a high credit score, you aren’t much of a risk to the bank so you enjoy lower rates.

Other factors that affect your loan interest rates are the amount of loan, loan tenure (lower rates for shorter spans), and market conditions (inflation, RBI policies, etc.).

Alright, let’s talk about loan repayment options. The most common way is Equated Monthly Installments (EMIs) where you pay a fixed amount each month. But don’t worry, you will be granted a moratorium period, or should we say, a grace period. It will give you 6-12 months after the completion of the course to find employment. Only after this moratorium period ends that your EMIs will commence.

If your bank allows it, you can also make a lump-sum payment towards the principal. It reduces both your loan duration and interest rate costs. Besides, you can pay off the entire loan before the tenure ends (prepayment). Again, you will have to check with your bank if they allow it.

In some banks, there are flexible repayment options that adjust based on the student’s income after graduation. These are perfect for early career stages so keep an eye out for them.

Interestingly, some banks even give you the option to pay only the interest during the moratorium period.

Education Loans by Destination

Depending on your study destination, some banks just have better loans and offers. So, during your research phase, you might want to take a look into those.

Education Loan for the USA –

The tuition fees and living costs are pretty high in the States so taking out a loan makes perfect sense. Here some of your options are –

- Bank of India’s Star Education Loan. It covers tuition, accommodation, and other related expenses. And hey, you don’t even need a collateral for loan amounts up to Rs.7.5 lakhs.

- Punjab National Bank (PNB)’s Udaan. It gives out loans up to Rs.1.5 crores. The repayment terms are flexible and no penalties on prepayment.

- MPOWER Financing. Known for giving out loans to international students without a cosigner or collateral. The amount can be up to 100k USD.

Education Loan for the UK –

Most students go to the UK for their masters. And there are several banks that give out loans specifically for this purpose.

- Bank of Baroda has the Baroda Scholar Loan. It covers tuition and living expenses up to Rs.1.5 crores. And there is no processing fee if your loan amount is under 7.5 lakhs.

- HDFC Credila gives out unsecured loans up to 45 lakhs with flexible repayment options. Also, their interest rates are quite competitive.

- Prodigy Finance is another option catering to such international students. It mostly gives out unsecured loans based on the student’s future earning potential.

Education Loan for Canada –

Canada’s tuition fees are hardly any different from that of the USA. So, if you planning to study in Canada, you might want to consider these options –

- State Bank of India (SBI) gives out loans that cover a wide range of courses at Canadian universities.

- Bank of Montreal (BMO) has tailored loan options for international students looking to study in Canada. Also, their rates are quite competitive.

- CIBC also gives out loans specifically to international students going to Canada.

Education Loan for Australia-

Australia is quite popular among Indian students planning to study abroad. And for good reason. The education quality is high and costs are comparatively affordable. If you are planning for Australia, keep an eye out for these options –

- Commonwealth Bank of Australia provides custom education loans with flexible repayment.

- ANZ Bank’s education loans cover tuition and living expenses at competitive rates.

- Westpac has a bunch of financial products that have been designed to help international students fund their education in Australia.

Education Loans by Program Level

Yup, there are education loans for specific program levels including bachelor’s, master’s and PhD. Let’s look at some of those here –

Education Loans for Undergraduate Studies-

- SBI gives out loans for bachelor’s courses up to 20 lakhs. And loans under 4 lakhs don’t even require collateral.

- PNB is another option that covers tuition and living expenses.

- Axis Bank has a simple and straightforward application process for undergraduate programs. And did I tell you that the rates are quite competitive?

Education Loans for Master’s Studies –

- Bank of Baroda’s Baroda Scholar Loan covers master’s up to Rs.80 lakhs for select colleges.

- HDFC Credila gives out custom education loans for master’s courses. And the loan amount is determined by the student’s future earning potential.

- ICICI Bank gives out loans up to Rs.1 crore for master’s programs.

Education Loans for PhD Programs –

- Canara Bank has some interesting loan offers for PhD students. But loans over 7.5 lakhs need collateral.

- Union Bank of India gives out loans up to 40 lakhs for students enrolled in doctoral programs at recognized colleges. No collateral needed.

- IDBI Bank covers tuition, research, and living expenses. Repayment options are flexible

Tips for Choosing the Right Bank

When picking a bank for your study loan, make sure to factor in interest rates, repayment terms, and tenure of the loan. Lower and fixed interest rates will make your life a whole easier.

Also, the job market can sometimes be unpredictable so don’t forget to consider a moratorium period as it will take the pressure off until you are earning and ready to start paying back.

Look for additional costs (often hidden) such as any processing fees. And only accept the offer after you thoroughly understand the terms of the contract.

Bottom Line

And there you go! That’s all you need to know to start planning your financial journey and fulfill your dreams in a foreign land.

Again, be as thorough in your research as you can be. Because sometimes a better option is just around the corner. If unsure at any point, seek advice from financial experts. And good luck!

FAQs

- I need an education loan. Do I qualify?

To qualify for an education loan, you will need to show some academic merit and meet other eligibility criteria set by your bank. You may sometimes need collateral.

- What if I can’t repay?

If you fail to repay due to unemployment or some other financial hardships, it’s best to discuss options with your bank.

- Can I repay early without any fines?

Yes, you can. But it totally depends on your bank. Some banks allow it, others don’t.

- Do I have to bring a co-applicant for my education loan?

Only if you don’t have any collateral and your only option is an unsecured loan.